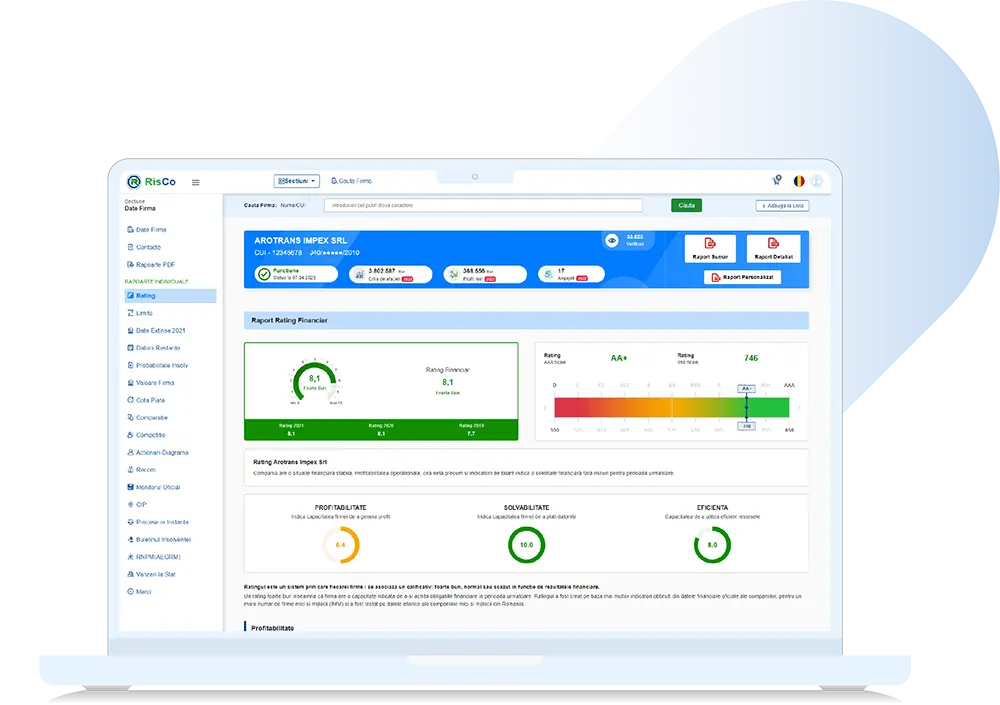

What the Financial Rating Report Represents

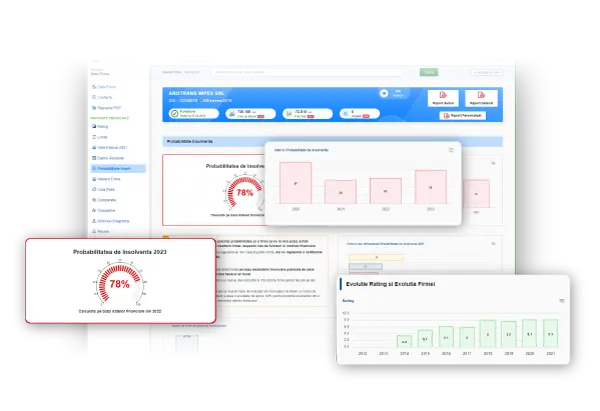

Financial Rating of a company represents the assessment of its financial capacity and stability, with a final qualification assigned:

very good, normal, or low, depending on each individual company. The financial rating provides an overview of a company's economic stability due to the objective assessment based on financial results, reported by domain and sector of activity.

Based on the company's financial situation, the financial rating indicates the level of risk associated with the economic activity carried out.

As a tool that uses indicators such as liquidity, profitability, solvency, and payment history,

the financial rating will help you make more informed and secure decisions to protect your company from various risks. The financial rating helps you make informed decisions and sign contracts only with serious companies.

A good rating, a sustainable partnership. A low rating, a risky collaboration eliminated!

Test for free for 7 days the company verification with RisCo Reports!

It's simple and fast: you open an account and get free access to test all reports

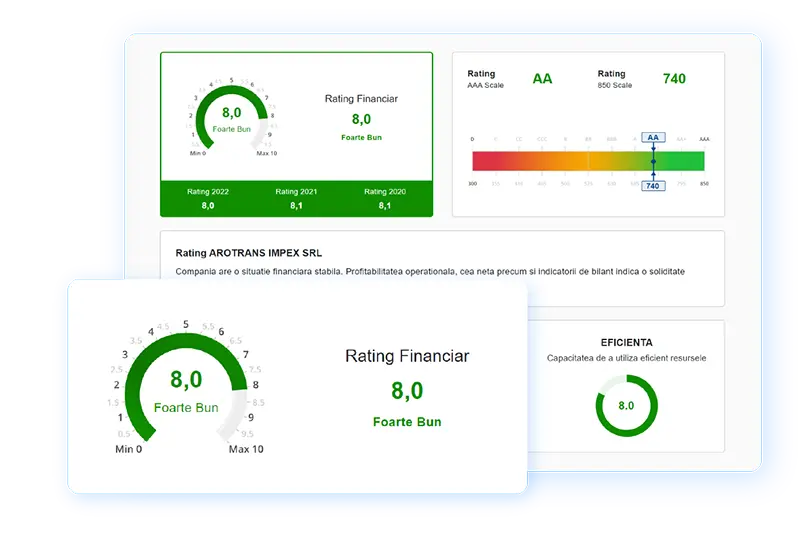

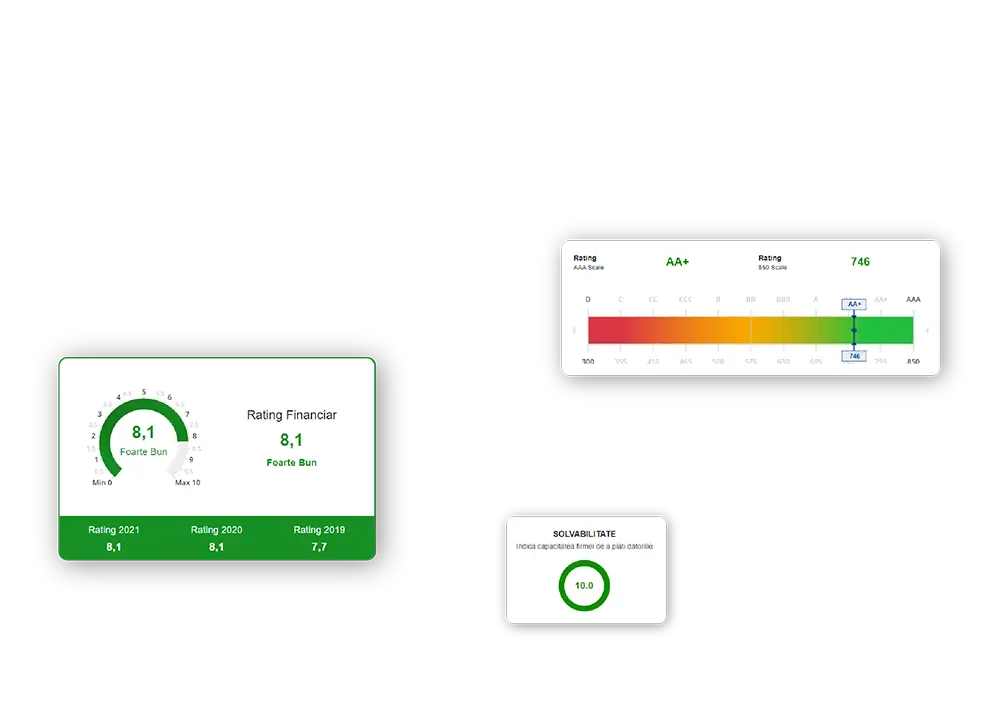

Very Good Financial Rating

The company has a stable financial situation. Operational profitability, company solvency, as well as balance sheet indicators indicate financial solidity without risks for the next period.

The very good rating indicates that the respective company recorded financial performance above the industry average in that financial year, and existing financial resources ensure coverage of medium-term payment obligations.

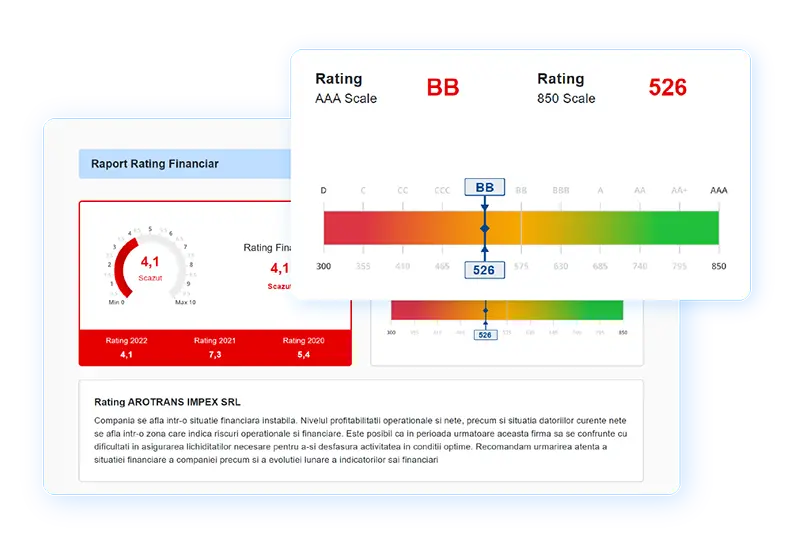

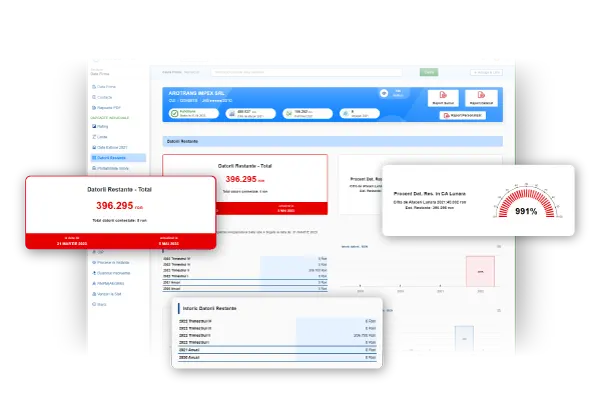

Low Financial Rating

The company has an unstable financial situation. The level of operational profitability, as well as the situation of current debts, are in an area indicating operational and financial risks.

It is possible that in the next period this company will face difficulties in ensuring the necessary liquidity to carry out its activity under optimal conditions.

For these companies, it is recommended to closely monitor the company's financial situation, the monthly evolution of its financial indicators, undertaking contractual relationships with the shortest payment terms, and tracking collections.

Advantages and Benefits of the Financial Rating Report

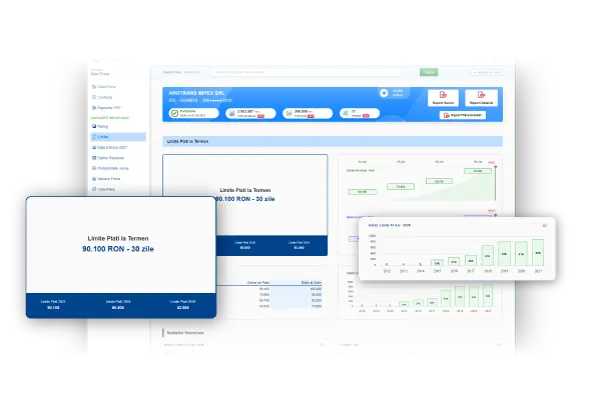

Financial risk assessment

Analyzing financial indicators allows the identification of main risks: high debt level, low profitability and liquidity.

Optimization of financial management

The report presents the economic situation of the company and allows the evaluation of the company's financial performance, as well as highlighting associated risks.

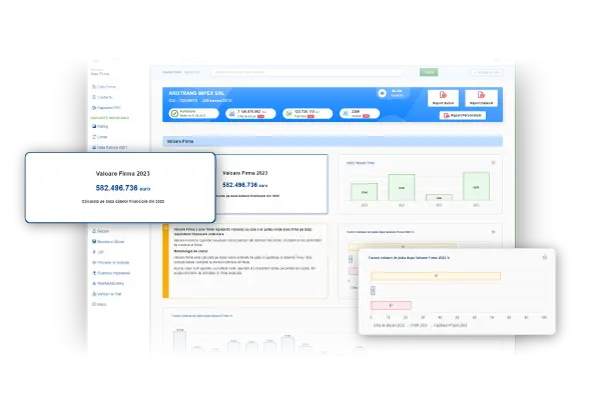

Improvement of the decision-making process

Business decisions will be made based on financial history, contributing to the growth and security of your company.

Increase in partner confidence

The financial rating provides assurance to clients, suppliers, and business partners regarding the fulfillment of financial obligations and adherence to payment deadlines.

Test for free for 7 days the company verification with RisCo Reports!

It's simple and fast: you open an account and get free access to test all reports

Product Prices Risk Reports

Financial Reports for Companies

Manage financial reports and determine the company's situation relative to the industry it belongs to.

Financial Reports

Market Reports

Si, intr-adevar, timpul de furnizare al rapoartelor este unul incomparabil mai mic fata de ceea ce ofera competitorii.

Flexibilitatea si personalizarea rapoartelor obtinute, preturile foarte bune, profesionalismul si atitudinea fata de client a reprezentantului RisCo reprezinta alte avantaje pentru care recomand serviciile RisCo.