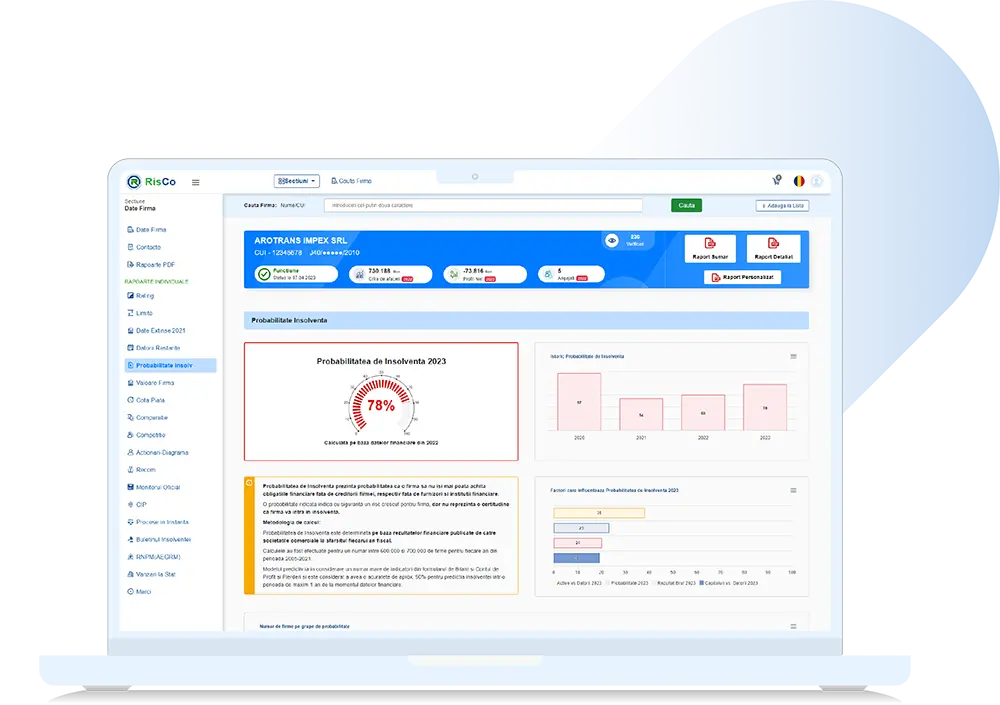

What the Insolvency Probability Report Represents

Insolvency Probability is the indicator that estimates the risk of a company no longer being able to meet and fulfill financial obligations such as invoices, loans, or debts to various financial institutions, suppliers, or collaborators, namely the company's creditors.

Insolvency Probability indicates that the company may enter payment incapacity or insolvency, due to the large number of financial obligations it has to fulfill and the lack of necessary resources.

Insolvency Probability is a theoretical indicator and estimates the risk of insolvency. This indicator does not provide any certainty regarding the occurrence of an event.

Test for free for 7 days the company verification with RisCo Reports!

It's simple and fast: you open an account and get free access to test all reports

Insolvency Probability and Associated Risk

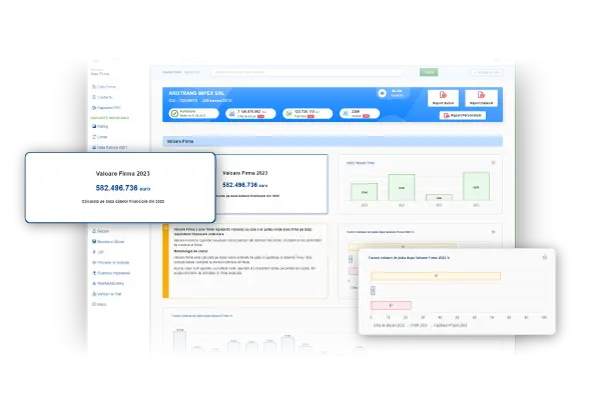

The Insolvency Probability Report provides an overview of a company's economic viability.

Depending on the company's financial situation, the report will indicate the degree of risk of the company entering insolvency: high, medium, or low.

High probability should not be neglected, as it certainly indicates financial problems and an increased risk for the company,

but it does not constitute a certainty that it will enter insolvency.

The Insolvency Probability Report is a strategic tool that contributes to improving risk management due to its reliable information from official sources.

Advantages and Benefits of the Insolvency Probability Report

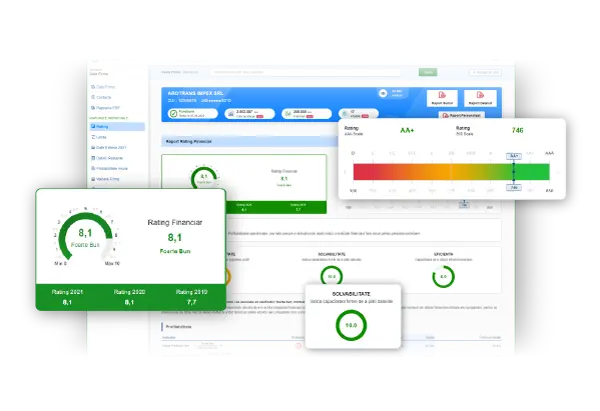

Risk assessment

Analyze the report and estimate the cash capacity available to your client portfolio according to financial results.

4-Year Statistics

Statistics from the last 4 years of activity provide an overview of the company's positioning from an insolvency probability perspective.

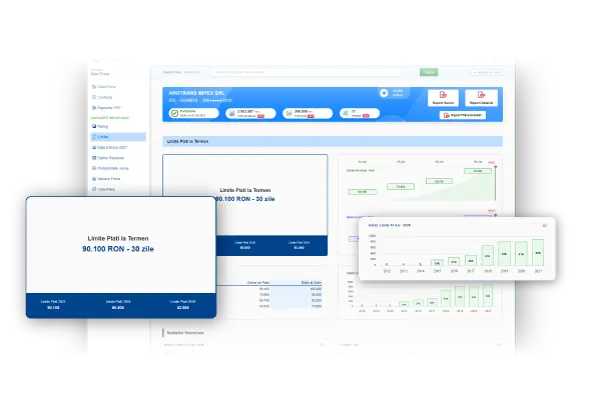

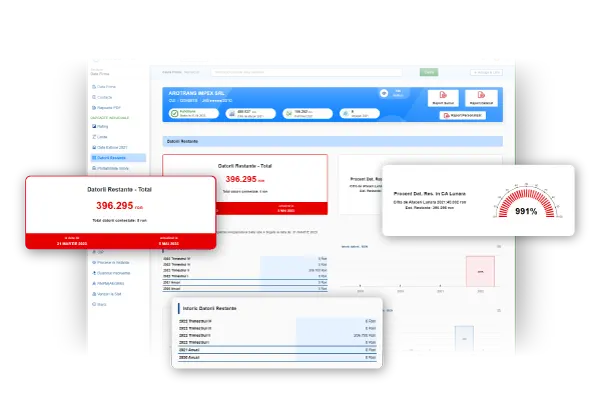

Optimal risk management

Early identification of risks by highlighting payment delays and negative antecedents to avoid financial losses.

Setting priorities

The report's information allows for the reorganization and reestablishment of company objectives: reducing discretionary expenses and renegotiating contractual terms.

Test for free for 7 days the company verification with RisCo Reports!

It's simple and fast: you open an account and get free access to test all reports

Product Prices Risk Reports

Financial Reports for Companies

Manage financial reports and determine the company's situation relative to the industry it belongs to.

Financial Reports

Market Reports

Si, intr-adevar, timpul de furnizare al rapoartelor este unul incomparabil mai mic fata de ceea ce ofera competitorii.

Flexibilitatea si personalizarea rapoartelor obtinute, preturile foarte bune, profesionalismul si atitudinea fata de client a reprezentantului RisCo reprezinta alte avantaje pentru care recomand serviciile RisCo.