What are Groups of Companies by Shareholding

Not sure about the collaboration?

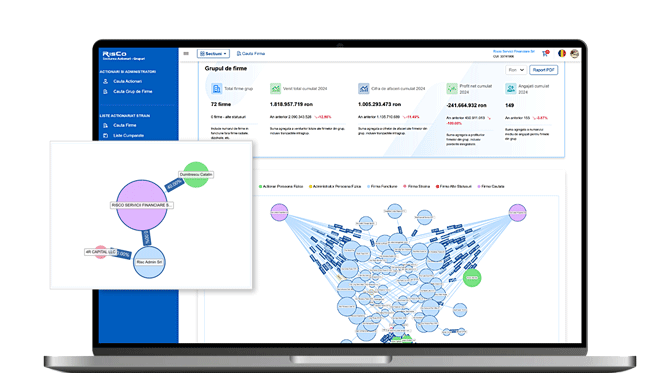

Search for the company of interest and find out the entire Group of Companies it belongs to based on significant shareholders and directors.

See the entire Group of Companies and understand its structure: who are the decision-makers, shareholders, and directors who have strengthened the company's market presence and what the consolidated financial data looks like.

Who is part of a Group of Companies?

Individuals who are significant shareholders and directors in the respective companies.

Because several people participate in the decision-making process, conflicting opinions can often arise. If the company of interest is part of a group of companies, the risks will not disappear, but will either be easier to manage due to the experience of the shareholders, or more complex due to the different fields. Evaluate and anticipate the risks before signing the contract.

Try 7 days for free and see Groups of Companies by Shareholding!

It's simple and fast: open an account and get free access to test the groups.

Features of Groups of Companies by Shareholding

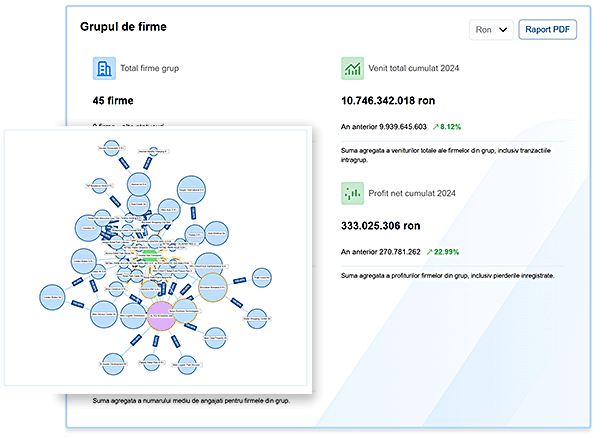

Group Diagram by Shareholder Holdings

The Group Diagram is a graphical representation of the companies forming the group through shares held by shareholders.

Individual shareholders, operating companies, foreign companies, companies with non-operating statuses, as well as the searched company are highlighted in different colors. Relationships between shareholders and companies are marked with the percentages held.

Individual shareholders, operating companies, foreign companies, companies with non-operating statuses, as well as the searched company are highlighted in different colors. Relationships between shareholders and companies are marked with the percentages held.

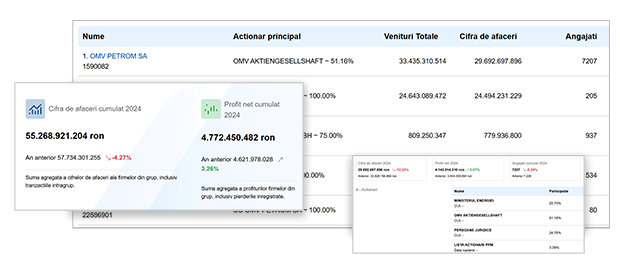

Shareholder and Director Details

The report shows the shareholders and the percentages held, as well as the directors of all companies in the group.

The information includes both individual shareholders and legal entities with shareholder status.

Similar to shareholders, all directors of the company, whether individuals or entities, are presented.

The information includes both individual shareholders and legal entities with shareholder status.

Similar to shareholders, all directors of the company, whether individuals or entities, are presented.

Consolidated Financial Data

For the entire Group of Companies, consolidated financial data is presented, including turnover, net profit, and number of employees for the last fiscal year. Intra-group transactions are included in the consolidated data.

Advantages and Benefits of Groups of Companies by Shareholding

Understanding the Group Structure

By understanding who the shareholders and directors are, as well as the shares they hold, you can adapt your strategy according to the group's interests and priorities.

Risk Assessment through Association

Knowing the relationships between the companies in the group provides a competitive advantage, allowing you to use this information for negotiation and to set new contractual terms.

Clarity on Intra-Group Relationships

Groups of Companies offer a complete picture of the companies in the group, from structure, decision-makers, and financial data to collaboration opportunities.

Improving Business Relationships

Strengthen existing business relationships and create new ones, taking into account the actions and shareholdings of the group of companies.

Try 7 days for free and see Groups of Companies by Shareholding!

It's simple and fast: open an account and get free access to test the groups.

Activate subscription with unlimited access.

Shareholders and Directors Subscriptions

You can perform unlimited searches by an individual's name and determine in which companies they hold shares, the percentage of ownership, the status of the companies, or whether they are a director..

RisCo subscriptions offer the greatest flexibility in choosing the best services according to each user's needs. They are structured in categories based on the desired service type, as well as different subscription periods: monthly, semiannual, and annual. Check the subscription offer for the best choices!

Si, intr-adevar, timpul de furnizare al rapoartelor este unul incomparabil mai mic fata de ceea ce ofera competitorii.

Flexibilitatea si personalizarea rapoartelor obtinute, preturile foarte bune, profesionalismul si atitudinea fata de client a reprezentantului RisCo reprezinta alte avantaje pentru care recomand serviciile RisCo.