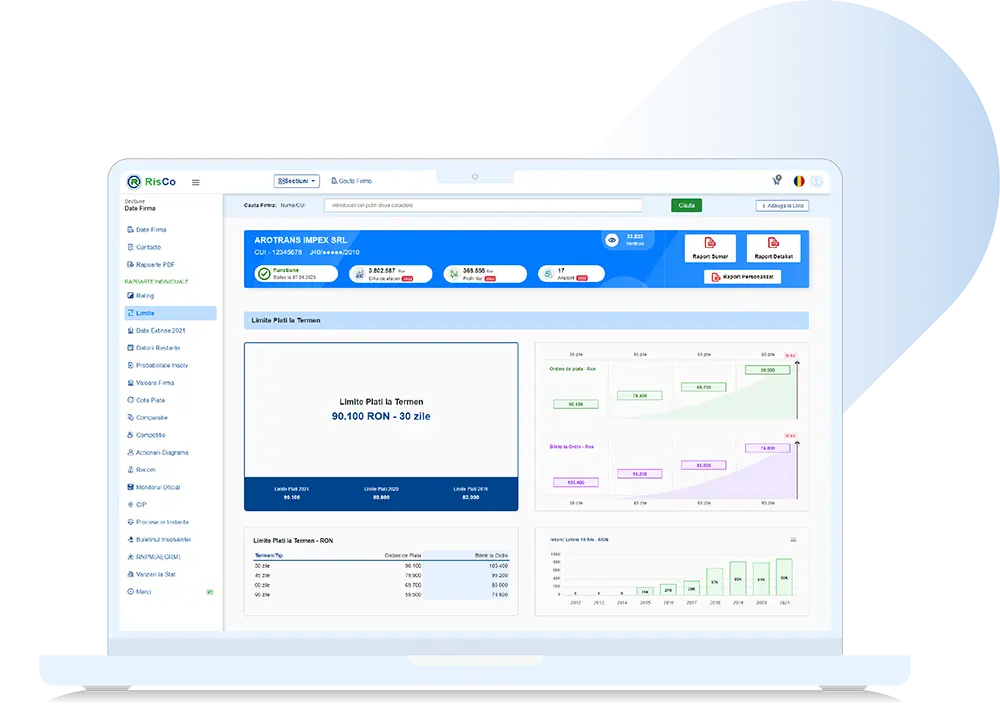

What the Trade Limits Report Represents

The Trade Limits Report represents the maximum amounts for which you can provide goods or services with deferred payment.

In other words, they refer to the maximum value that your clients and collaborators can provide in the case of deferred payments.

If sales with deferred payment represent your company's main activity, it is essential to know who you invoice and who your client is.

Establish limits and personalize contractual conditions that your client portfolio can meet, so that your company avoids the risk of non-payment.

Using a report like Trade Limits you can assess the creditworthiness of your portfolio of clients, suppliers, and collaborators.

Additionally, clearly establishing payment limits allows the improvement of commercial relationships due to understanding client behavior.

Test for free for 7 days the company verification with RisCo Reports!

It's simple and fast: you open an account and get free access to test all reports

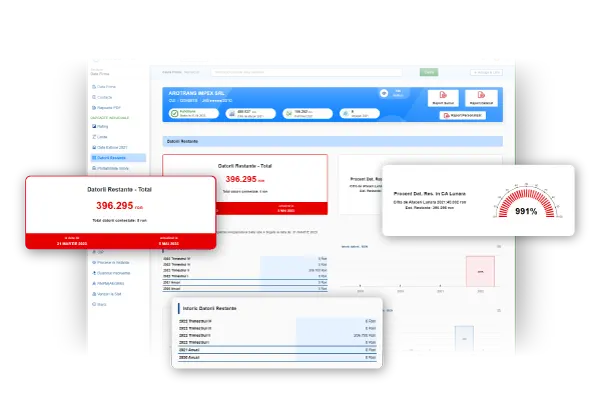

Payment Limits and Associated Risk

Trade instruments, such as promissory notes and checks, are used for invoice settlement.

Non-payment leads to the company being registered in the Payment Incidents Center.

Consequently, companies are more cautious and set higher payment limits for these than for invoices paid by payment order.

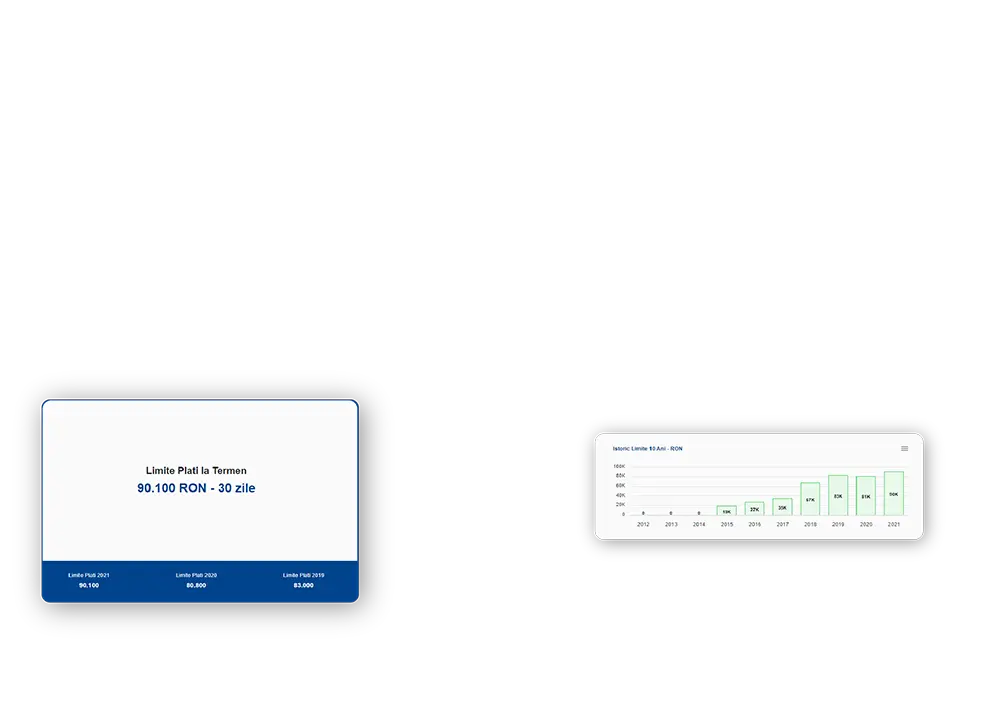

The longer the payment terms, the higher the risk of non-collection.

For this reason, 90-day payment limits are significantly lower than 30-day limits. In a 90-day period, the paying company is exposed to more risks than in a 30-day period.

Payments made through promissory notes or checks have lower risk than normal payments through payment orders.

For this reason, payment limits for promissory notes and checks are higher than normal ones.

Advantages and Benefits of the Trade Limits Report

Establishing realistic payment limits

Analyze the report and estimate the cash capacity available to your client portfolio according to financial results.

Limits for invoices, checks, and promissory notes

Limits for standard payment terms are calculated taking into account the risks associated with payment instruments.

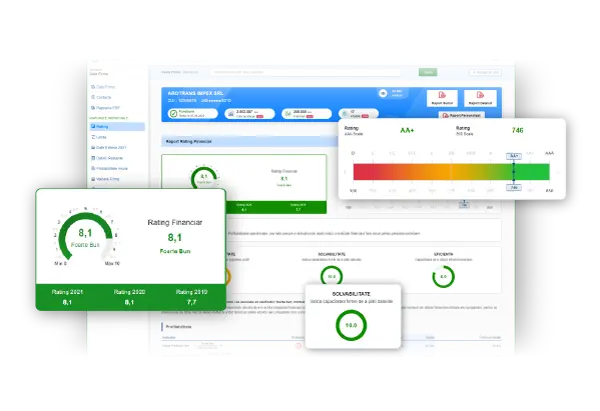

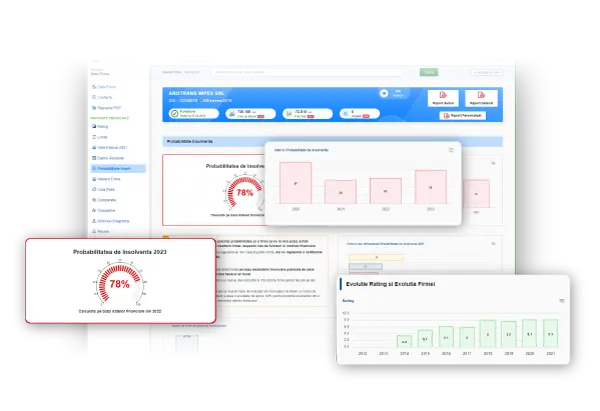

Optimal risk management

Early risk identification by highlighting payment delays and negative antecedents to avoid financial losses.

Assessing client creditworthiness

The Trade Limits Report allows identification of risks associated with various transactions, enabling your company to avoid fraudulent collaborations.

Test for free for 7 days the company verification with RisCo Reports!

It's simple and fast: you open an account and get free access to test all reports

Product Prices Risk Reports

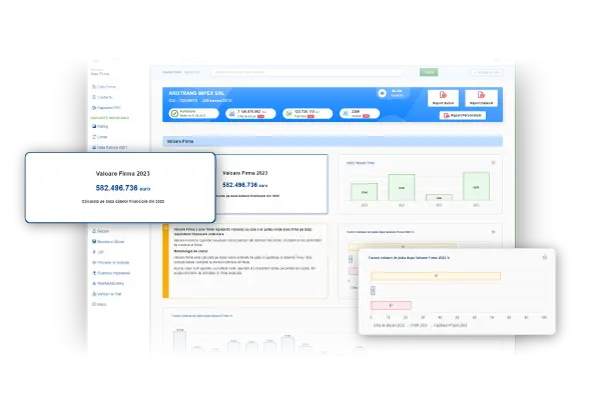

Financial Reports for Companies

Manage financial reports and determine the company's situation relative to the industry it belongs to.

Financial Reports

Market Reports

Si, intr-adevar, timpul de furnizare al rapoartelor este unul incomparabil mai mic fata de ceea ce ofera competitorii.

Flexibilitatea si personalizarea rapoartelor obtinute, preturile foarte bune, profesionalismul si atitudinea fata de client a reprezentantului RisCo reprezinta alte avantaje pentru care recomand serviciile RisCo.