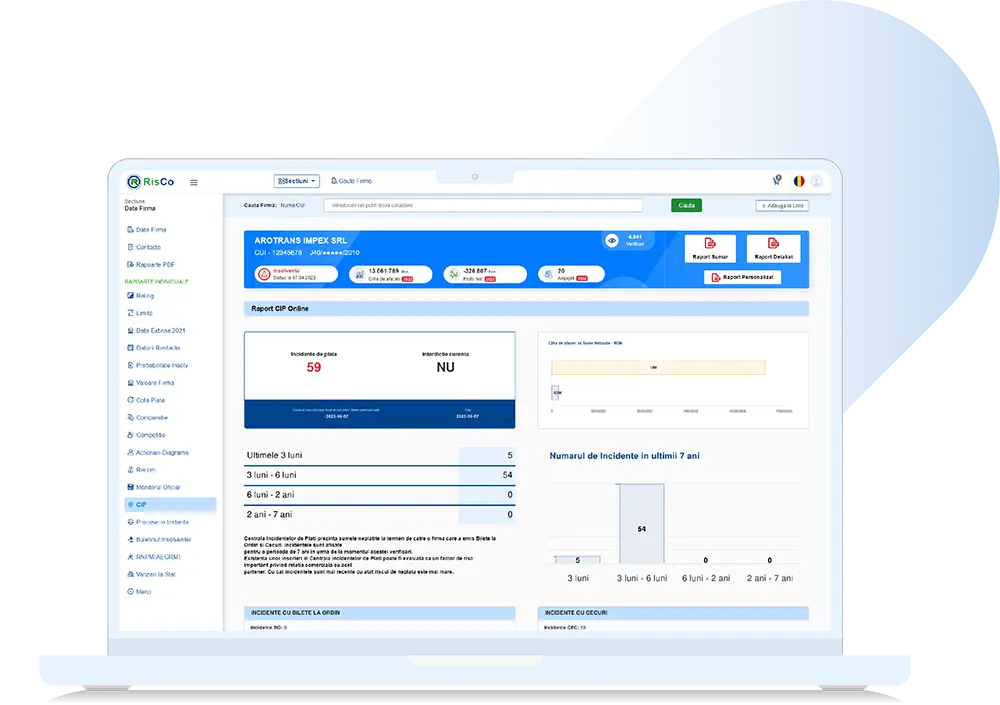

What the Payment Incidents Report represents

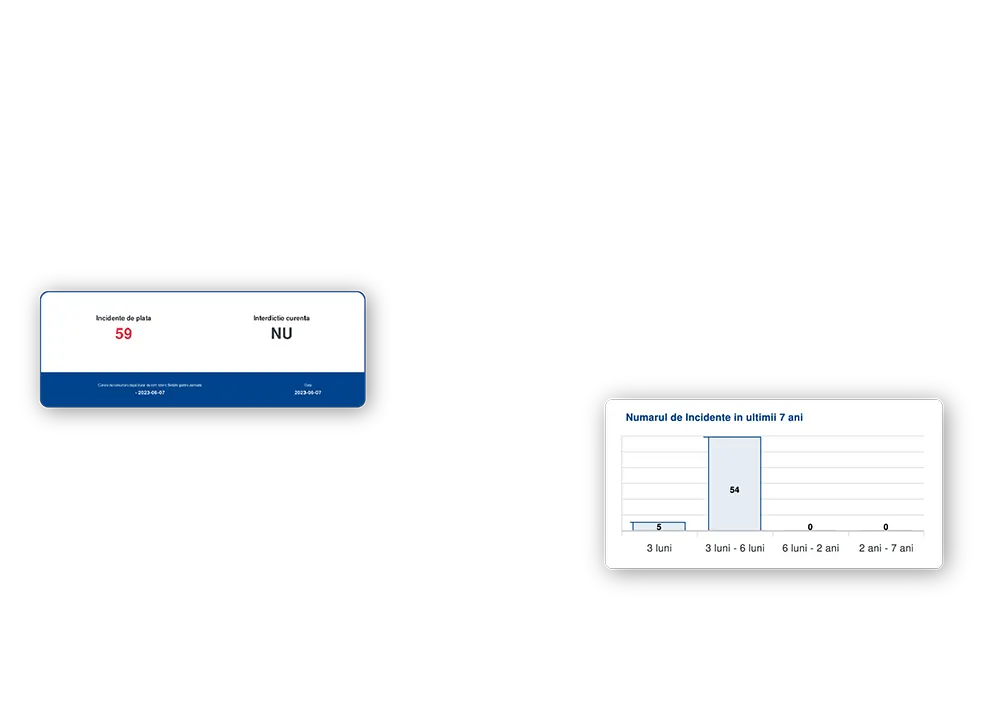

Payment Incidents Online report shows the payment instruments with Promissory Notes and Cheques issued by a company in the last 7 years.

The Payment Incidents report indicates both the financially difficult periods of a company and the corresponding amounts: major or minor. Analyze checks and promissory notes issued: is the company financially disciplined or does it exceed deadlines?

The more frequent the incidents, the more defective its financial management is.

If the cumulative amounts of incidents are significant, then the company has chances of entering payment incapacity.

Test for free for 7 days the company verification with RisCo Reports!

It's simple and fast: you open an account and get free access to test all reports

Payment Incidents and Associated Risks

The Online Payment Incidents Report reflects accumulated amounts from both minor and major payment incidents throughout the company's 7 years of activity.

The report also includes the number of refused instruments over the 7 years.

If the company has no incidents or does not appear as registered in the Payment Incidents in the last 7 years, it is considered that

having higher creditworthiness. At the same time, the lack of payment incidents may also suggest that the company has well-established cash flow management and that it strictly respects its payment deadlines.

If the company records Payment Incidents, it means it has failed to fulfill its assumed payment obligations!

This situation puts the company in a very difficult position towards its partners. Payment incidents suggest that a company cannot meet its payment obligations.

The more frequent and recent these are, the more serious the situation.

Advantages and Benefits of Payment Incidents Report

List of payment incidents

Frecventa incidentelor de plati indica aparitia iminenta a procedurii de insolventa. Analizeaza sumele cumulate conduce la evaluarea pozitiva sau negativa a firmei.

Explanatory table for easier understanding

Study the payment incidents table to determine the date when payment refusal occurred, as well as the series and specific number of the payment incident.

Analysis of payment discipline

From minor to major incidents, the Payment Incidents report provides a picture of cash flow management capacity and fulfillment of financial obligations.

Improved decision-making process

Ia decizii pe baza informatiilor sigure si oficiale, astfel incat firma ta sa nu fie expusa riscurilor. Gandeste strategic si alege colaboratorii cu atentie.

Test for free for 7 days the company verification with RisCo Reports!

It's simple and fast: you open an account and get free access to test all reports

Product Prices Risk Reports

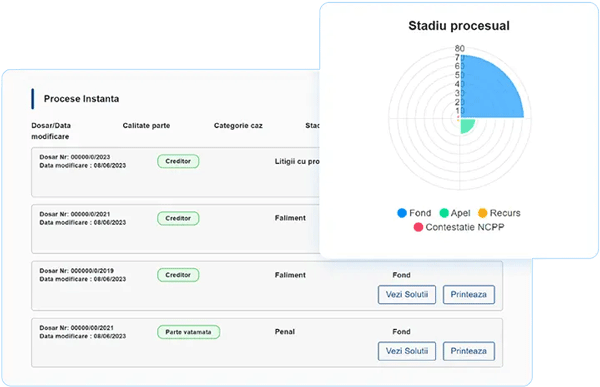

Legal Reports for Companies

Manage legal reports and determine the company's situation.

Financial Reports

Market Reports

Si, intr-adevar, timpul de furnizare al rapoartelor este unul incomparabil mai mic fata de ceea ce ofera competitorii.

Flexibilitatea si personalizarea rapoartelor obtinute, preturile foarte bune, profesionalismul si atitudinea fata de client a reprezentantului RisCo reprezinta alte avantaje pentru care recomand serviciile RisCo.