RisCo EXPERT - 3000 Credits

On-Demand Company Checks – 3000 RisCo Credits: The specific information you need, in just 20 seconds.

RisCo Credits give you on-demand access to essential information about Romanian or international companies, specific reports, company databases, or industry analysis, within the limit of the purchased credits.

What does On-Demand Company Checks – 3000 RisCo Credits the include and what does it grant access to?

You receive on-demand access, based on the 3000 credits, to the following types of information:

| Financial Reports | Credits | |

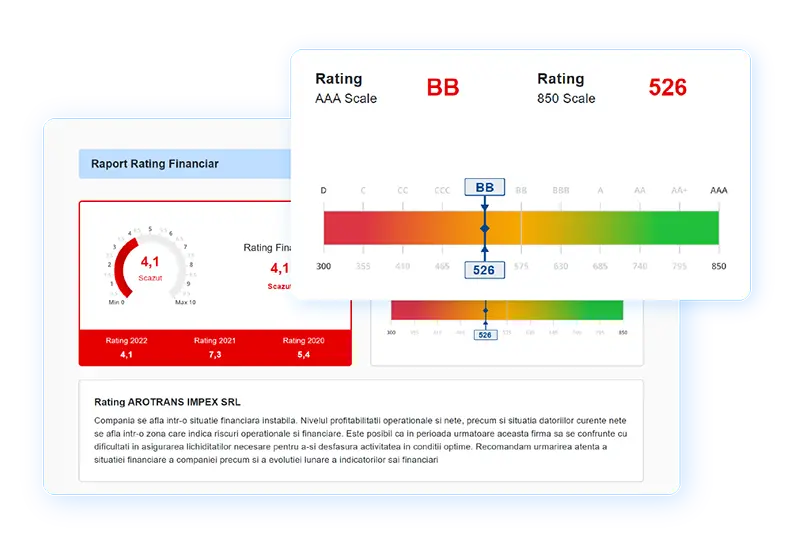

| Financial Rating | 4 credits | Evaluates a company's ability to meet its obligations based on balance sheet data and industry benchmarks. |

| Term Payment Limits | 2 credits | Maximum trade credit limit that should be extended to a customer, based on their ability to pay. |

| Insolvency Probability | 2 credits | Likelihood that a company will be unable to meet its financial obligations to creditors, suppliers, or financial institutions. |

| Outstanding Debts | 2 credits | Indicates the risk of account garnishment due to debts owed to the state budget. The higher the debts, the higher the account blocking risk. |

| CIP Online | 4 credits | Shows payment history, bounced checks, and promissory notes — essential for evaluating client reliability and commercial risk. |

| Extended Financial Data | 8 credits | Detailed financials: balance sheet, P&L statement, 10-year history, KPIs, financial trends, asset/liability structure, liquidity, profitability. |

| Legal Reports | ||

| Shareholders and Directors | 10 credits | Includes company shareholders, ultimate beneficial owners, ownership percentages, and related party structures. |

| Court Cases | 2 credits | Covers current court cases, the company’s role, case category, and case resolution details. |

| AEGRM | 4 credits | Registered movable asset guarantees against a company’s assets. |

| Official Gazette | 10 credits | Includes all official updates on shareholders, directors, company addresses, and legal changes. |

| Secondary NACE Codes | 2 credits | Additional business activities a company is authorized to perform besides its main activity. |

| Business Locations | 2 credits | Lists secondary offices and work sites. |

| Insolvency Bulletin | 2 credits | Shows whether an insolvency procedure has been initiated or is ongoing, including procedural stages. |

| Trade Register | 35 credits | Updated legal information from the Romanian Trade Registry: company status, headquarters, business activities, directors, shareholders. |

| Market Reports | ||

| Market Value | 2 credits | Estimates a company’s economic value based on financials and performance indicators. |

| Market Share | 2 credits | Company’s turnover as a percentage of total turnover in its county or national industry sector. |

| Company Comparison | 2 credits | Compare your target company with the largest player in its field or with any other company. |

| Competition | 2 credits | Shows company ranking locally or nationally within its industry, as well as top competitors and their growth. |

| Sales to the State | 2 credits | Shows the value and frequency of contracts signed with public institutions (public procurement). |

| Registered Trademarks | 2 credits | Lists all trademarks registered with OSIM by a company (active or pending). |

| Summary Report | 30 credits | Key conclusions from all risk-related reports. |

| Detailed Report | 53 credits | Full legal and financial information. |

| International Report | 250 credits | Reports on companies based outside Romania. |

| Company Databases | Custom pricing | Export financial data and contacts to Excel files. |

| Sectoral Studies | 100 credits | In-depth industry-specific analysis. |

Who is On-Demand Company Checks – 3000 RisCo Credits for?

-

Entrepreneurs and Managers – who want to verify partners, suppliers, or clients before contracts or to set credit/payment terms.

-

Finance and Accounting Departments – who monitor debt collection risks and aim to avoid cash flow disruptions.

-

Sales and Procurement Teams – who evaluate client reliability and compare vendors or clients for lower business risks.

-

Banks and Credit Institutions – for credit or leasing decision-making processes.

Credit Package Features:

The credit package offers on-demand access for a 12-month period, allowing users to search for companies and obtain information about them.

Companies can be searched using their Tax Identification Number (CUI) or company name.

Reports can be accessed online or downloaded in PDF format.

Both the summary and the detailed versions of the report can be extracted as PDFs.

The information is sourced from public databases and updated daily.

Users have access to the history of previously accessed reports.

Reports can also be generated in English, with the chosen currency being either Euro or US Dollar.

Reports can be sent by email in PDF format, and the financial data can be provided in Excel format.

Databases can be accessed as Excel files and downloaded using available credits.

International reports can also be downloaded online.

Payment for the Credit Package:

Payment for the credit package is made in advance, either by bank card or by requesting the issuance of a tax invoice.

Credits are activated immediately after the tax invoice is issued.

If the credits have not been used within 14 days, the user may request the cancellation of the package and a refund of the amount paid.

If some of the credits have been used during the 14-day period or after the 14 days from the purchase date, the paid amounts will no longer be refunded.

Other products of interest to you

| Company: | RisCo Servicii Financiare SRL |

| Unique Registration Code(CUI): | 33741906 |

| Registration Number: | J2014012529404 |

| EUID: | ROONRC.J2014012529404 |

| Address: | Bdul Pierre de Coubertin 3-5, Office Building, etaj 5, sector 2, Bucuresti |